Risk insurance policies are financial products that will pay the policy holder if the ‘insured event’ – such as becoming unwell and being unable to work – happens.

Risk insurance policies are financial products that will pay the policy holder if the ‘insured event’ – such as becoming unwell and being unable to work – happens.

Insured events include things like temporary illness, permanent illness, temporary injury, permanent injury, or the premature death of the insured person.

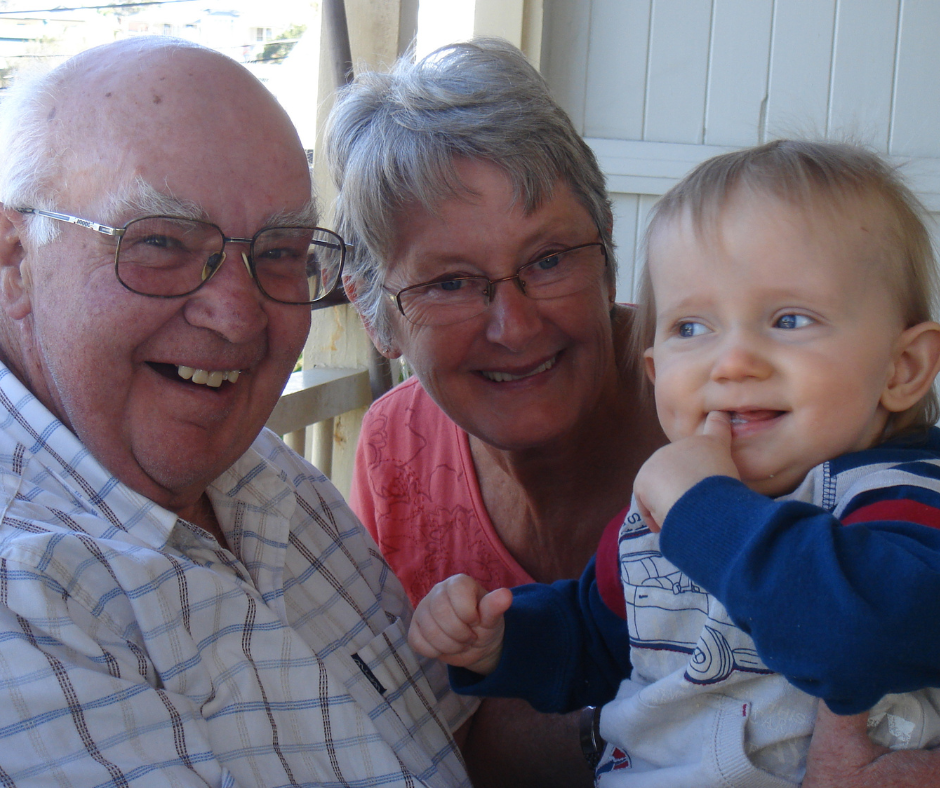

Risk insurances insure your good health, which is actually your most important financial asset. That is why risk insurances are almost always the essential first step in any financial plan. Insuring yourself against a loss of income or earning ability allows you to ensure that life for you and your loved ones goes on with the quality you want, even if something unwanted happens.

We provide the complete range of risk insurance services: death cover, total and permanent disability (TPD), income protection and trauma cover. We help you calculate the type and amount of each cover that you might need, as well as discuss other ways that you can protect yourself against financial loss.

We also show you how to minimise the premiums, especially after-tax, without unnecessarily compromising the quality of the policy or the level of cover that you acquire.

If cash flow is tight, we can assist you to find ways to insure yourself that minimise the demands on your day-to-day income. And, of course, as financial planners we can help you find ways to enhance your income. This makes everything more affordable, not just your insurances.

Relevant Articles …

7 tips for living your best life

We all want to be living the best life we can. This week I read a book by Norman […]

Stop emotions controlling investments

People do some silly things with money, but most of them are driven by three emotions. Greed, ego and fear. […]

Six ways to get a positive money mindset

The importance of a positive money mindset

As with the rest of your life, it is important to have a positive […]

Financial planning is about having the freedom to live life now

Financial planning is about more than money

Financial planning, when done right, should give you the freedom to live the life […]

Financial planning in your 50s

This article covers the nine things you should focus on with regards to financial planning in your 50s.

Milestone birthdays usually […]