What are three things you can do to make work optional sooner?

A lot has happened in the last 12 months.

This time last year, most of Australia was in the middle of lockdown, we were all longing to be able to see our extended family, the Government was rolling out the COVID vaccination program, many businesses were still closed, and the Australian share market was 5% higher than it is now.

On a personal note, I was at the beginning of a very significant health scare. One that required too many trips to hospital and too many specialists. It tried its best to break us, but with the help of our wonderful support team we made it through the other side.

While it sucked having to go through it, it has certainly given me a much clearer sense of perspective.

It taught me not to sweat the small stuff. It is not worth it.

Live your life now. Do not put something off until “there is a better time”. That time may get taken away from you before you get to do it.

Most of us have the ability to create our ideal life. There is no better time to start than right now. From today, every decision you make should be aimed at creating the life you want.

This week I was reading an article written by a 35-year-old who had retired. Besides the things he did to be able to do this, the biggest thing I took away was if he could retire at 35, there is no reason why a 40-year-old could not retire at 50, or a 45 year old retire at 55.

A lot of people get scared by the thought of retiring, so for those, let us call it making work optional.

Below are the big mistakes people do that stops them making work optional sooner.

Spend too much on ‘stuff’

We are constantly bombarded with ways to spend our money. A new TV that has a clearer picture. A new phone that has a better camera and longer-lasting battery. Pre-cooked meals that save you time.

Instead of finding ways to spend money, find ways to have fun and enjoy yourself without needing to buy new shiny toys.

Money that you spend now delays your ability to make work optional sooner.

Not maximising their income

This is commonly due to three things. Firstly, not having the confidence to ask for more and/or changing jobs regularly to get promotions. Secondly, being happy to coast along and not challenge yourself. Thirdly, not putting more time and effort into your work so you can develop a side hustle.

Be good at your job and continually strive to get as good of an income as you can from it.

No investment plan

Assuming you are earning as much as you can and are a good saver, it is critical to invest wisely.

Successful investing requires four main things:

- Diversification across different asset classes, industries and countries

- Minimising your investment fees

- Using debt wisely

- Making the most of the tax incentives of super.

If you want to discuss how you can fast track your way to making work optional, book a chat via the button below or contact us on 0417 034 252 or at office@constructwealth.com.au.

About the Author

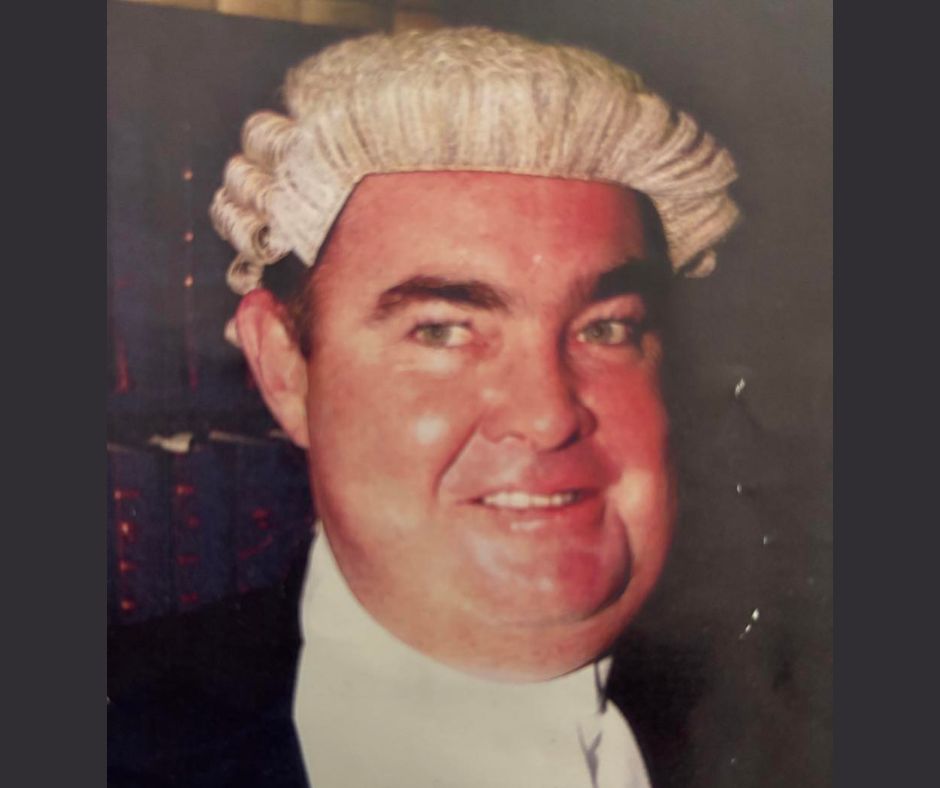

Phil Harvey is an independent financial adviser. In 2017 Phil set up his company Construct Wealth to help clients best manage their finances so they focus on what is important to them. He is a founding member of the Profession of Independent Financial Advisers and a tax financial adviser, registered with the Tax Practitioners Board.

General Advice Warning

This advice contains general information. It may not be suitable to you because it does not consider your personal circumstances. Phil Harvey and Construct Wealth are authorised representatives of Independent Financial Advisers Australia (AFSL 464629)

See related articles

Pay off the mortgage or invest?

Do I pay off the mortgage quicker - or invest? One of the most common questions we hear is: “Should we throw extra money at the mortgage, [...]

Your destination won’t change, unless you do

Having the best of intentions or the perfect plan is not enough. There needs to be action to have any chance of success. I was reminded of [...]

Live your life well

A few weeks ago I was given a blunt reminder on how important it is to make the most of your life and prioritise your health. At [...]