Heraclitus, a Greek philosopher, who was known for his doctrine of change, once said “change is the only constant in life.” Having an 11 year old son, I often think about what the world will be like when he is older.

Think about how different our life is to our parent or grandparents.

- Australians currently spend about 30% of disposable income on necessities. In 1925 it was more than 90%

- In 1975 there was no such as a digital camera. Now everyone has one on their phone.

- If you were born in 1950, you had an average life expectancy of 68 years. If you are born today your life expectancy is 84 years.

- Today more than 70% of kids that start high school complete year 12. In 1970 it was less than 30%.

I am not a futurist, but here are some of my predictions for 2040.

“Change is the only constant in life”

Health

While many of us now wear watches that track how many steps we take, this will pale into insignificance to what the future will look like. I imagine we will all be wearing sensors that track more detailed things like blood sugar levels, liver function tests and the presence of cancer cells. The doctors will alert us when something is wrong.

Transport

Petrol cars will be completely phased out and most cars will be driverless. Most people except those in rural areas and the wealthy won’t own their own car. Instead, we will pay an annual membership to a company car sharing company that will give us access to cars whenever you need.

Working

COVID-19 has forced us to change the way we work. Companies and governments have been forced to set up structures that allow people to work off-site. In 2040, most people will work remotely, whether at home or in specially designed business hubs scattered through cities and towns. In addition, most companies will employ people to fulfil tasks or projects, rather than in full-time roles.

Artificial Intelligence

Artificial intelligence and machine learning are expected to be the next big thing. This could even rival the industrial revolution. Lawyers will have computers researching their cases for them; restaurants will be able to predict what their customers will order; houses will be built in factories more than they are now; and matching employees and tasks will be easier to do.

Why thinking about the future when investing is important

There are two parts to it.

Firstly, most of the major changes over time aren’t due to major breakthroughs. They are generally due to small, constant changes over time. Computer processing speed for example has doubled every year since 1975. The same goes with investing. Sure you can hold out hope that you will receive a big lump sum or inheritance before you retire or that one big bet on cryptocurrency will pay off. However, a much better way is to invest regularly and take advantage of the benefits of compounding.

The second part is to consider the future when investing. There has recently been a few new index funds come onto the market that allow you to invest in different industries. This lets you invest in areas such as artificial intelligence, clean energy, cloud computing and healthcare.

I wouldn’t recommend putting all your savings into these emerging industries due to the increased risk. However, it is likely that investments in forward looking industries will perform well over the next 10 or 20 years. It is worth considering some of them in your portfolio.

We specialise in helping people build wealth to give them certainty for the future. If you would like to discuss how we could help you, book a chat via the button below. Alternatively call us on 0417034252 or email us at office@constructwealth.com.au.

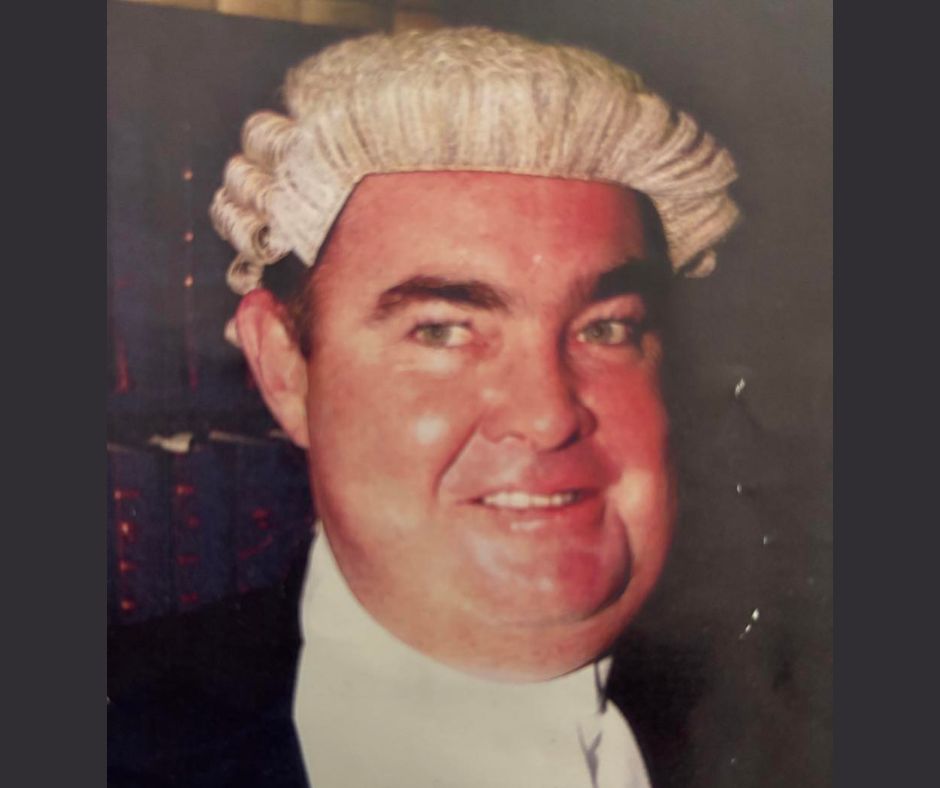

About the Author

Phil Harvey is an independent financial adviser. In 2017 Phil set up his company Construct Wealth to help clients best manage their finances so they focus on what is important to them. He is a founding member of the Profession of Independent Financial Advisers and a tax financial adviser, registered with the Tax Practitioners Board.

General Advice Warning

This advice contains general information. It may not be suitable to you because it does not consider your personal circumstances. Phil Harvey and Construct Wealth are authorised representatives of Independent Financial Advisers Australia (AFSL 464629)

See related articles

Live your life well

A few weeks ago I was given a blunt reminder on how important it is to make the most of your life and prioritise your health.At the end [...]

Don’t just set your goals. Be your goals.

Happy New Year! Last year was good, but here’s to hoping this year will be the best one yet. While 2024 was a good year, it could [...]

The most important thing about investing is to start

Most people want to be financially secure, but they also want the ability to keep doing the things that are most important to them. To be financially [...]